Chris Peacock, our new Chief Technology Officer

We’re thrilled to introduce the newest member of our GPS Insight family: Chris Peacock, our visionary Chief Technology Officer. With a passion for pushing boundaries and a track record of driving technological innovation and scale, Chris is poised to lead us into a future filled with cutting-edge solutions and transformative advancements.

Faton Gjuka, our new Chief Revenue Officer

We’re thrilled to announce the newest addition to our GPS Insight family: Faton Gjuka, our dynamic Chief Revenue Officer. Faton arrives with a robust background in fueling revenue growth and nurturing robust client relationships, setting the stage for an exciting chapter of expansion and innovation within our company.

Top 5 Tips on Lowering Fleet Insurance Costs

The economy is heading in a more expensive direction for fleet operations, and insurance companies know this. So, as a fleet manager, what can you do? Here are 5 top tips on lowering fleet insurance costs from GPS Insight.

This is why fleet data management is an integral part of the telematics industry, and GPS Insight is here to help you figure out what to do with your telematics data to improve those bottom lines and overall results.

Top 5 Tips on Fleet Data Management

Fleet managers get tons of reports every week and make even more about the fleet they’re managing. When most of those reports present bad news, consistently showing negative trends, or just not giving you what you need, things can get frustrating.

This is why fleet data management is an integral part of the telematics industry, and GPS Insight is here to help you figure out what to do with your telematics data to improve those bottom lines and overall results.

How to Retain Truck Drivers for Your Fleet

How do you keep your best drivers from leaving your trucking company for another? The key is in prioritizing their safety and well-being.

Lytx vs Samsara vs GPS Insight

Comparing top players in the telematics and fleet management industry is challenging, but the most crucial factor for decision-making is top-tier customer service. When comparing fleet management solutions, Lytx vs Samsara vs GPS Insight is a great place to start. But what sets the three apart?

Fleet Management Best Practices

As a company committed to providing solutions for fleet managers, we’ve put together a list of fleet management best practices to smooth over fleet operations and hopefully help you make more informed decisions.

Samsara vs Motive vs GPS Insight

If you’re comparing Samsara vs Motive, you’re more than likely looking for a fleet management system that is innovative, dependable, and custom fit to your needs. When it comes to Samsara vs Motive vs GPS Insight, here’s how your options stack up: 1. GPS Insight, 2. Samsara, 3. Motive

Ensuring Smooth Sailing: Why Strong Data Security is Important in Fleet Management Operations

Working with solutions that prioritize fleet data management and security can mean the difference between safety and a breach. At GPS Insight, we excel in tackling your challenges through our advanced real-time tracking solution, ensuring the safety and security of your data.

Top Samsara Competitors

Before you commit to Samsara, check out the top Samsara competitors for fleet management solutions.

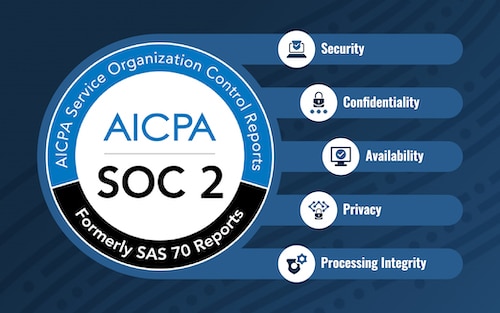

Why is SOC 2 Important?

What is SOC 2, and why is SOC 2 important? Keep your customer data safe and secure.

Let’s get visible: Driveri Hub-X improves monitoring and safety with a 360-view

We’re excited to announce Driveri Hub-X, which lets drivers get a 360-degree view of their vehicles, both inside and out. Driveri Hub-X, an accessory to the Driveri safety camera, drastically reduces your fleet’s blind spots and takes the effectiveness of your safety camera program to a whole new level.

Data Management For Your Fleet

As a fleet manager, you do everything in your power to keep your drivers safe and your customers satisfied. Data management for your fleet is more than hiring an IT specialist. Read more to find out what steps you can take to protect your fleet and customers.

5 Fuel Efficient Habits for Your Fleet in 2024

The cost of fuel typically makes up the largest expense for a fleet. In 2024, fleet managers can cut costs on fuel by building smart habits and investing in fleet management systems to ensure fleet fuel efficiency. Here are 5 fuel efficient habits for fleets 2024.

What to Do if Your Trailer Gets Stolen

You’ve invested your time, money, and energy into locks for your travel trailers, but a determined thief still managed to pull one over on you – and now it’s gone. Read more to find out what to do if your trailer gets stolen!

New Year’s Resolutions for Your Fleet

Take the first positive step forward for this year and plan a strategy that works for your business. Check out some of the best new year’s resolutions for your fleet.

How To Do Payroll For Truck Drivers

With all the available software out there, organizing payroll for truckers has never been easier. The true challenge that comes with it all is determining what software is the best for your business.

Demolishing Heavy Equipment Theft

Prevent heavy equipment theft with anti-theft devices by using the top GPS tracking and dash cam solutions at GPS Insight.

Best Rental Equipment Trackers for Your Fleet

With the GPS Insight tracking system, you can take the guesswork out of tracking your heavy equipment and other assets. Our tracking solution has cut costs on tracking heavy machinery and rental equipment by resolving billing disputes stemming from inaccurate job costs.

How Many Hours Can a Commercial Dash Cam Record?

Uncover the answer to ‘How many hours can a commercial dash cam record’ in our in-depth article. Learn about recording limits, memory options, and latest advancements in how to protect your fleet, and reliable recording for commercial vehicles.

Choosing the Best Dash Cam for Commercial Vehicles: A Comparative Guide

If you’re searching for the best dash cam for commercial vehicles, chances are you need help. However, the critical question for fleet managers remains: which dash cams are worth the investment?

Samsara vs Verizon Connect vs GPS Insight: What’s the top Fleet Management Solution?

Fleet management software and GPS tracking systems are valuable tools to streamline operations, save costs, and enhance productivity. Let’s look at a detailed comparison of Samsara, Verizon Connect, and GPS Insight solutions, considering factors like pricing, functionality, customer support, and user-friendliness.

Top 5 Ways to Prepare Your Fleet for Winter

Black ice, salted roads, and harsh weather conditions are a few things that can take a toll on your vehicles and your drivers. With the winter season as unforgiving as it typically is, fleet managers don’t always have the foresight to “expect the unexpected.”

This results in complications down the road. Thankfully, we’ve got you covered. Here are our Top 5 Ways to Prepare Your Fleet for Winter.

Maximize Tax Savings with Section 179 Deductions on GPS Vehicle Tracking Software

Discover how Section 179 deductions can significantly reduce your costs when implementing GPS vehicle tracking software. Learn about the latest IRS updates, eligibility criteria, and real-world examples of savings for your fleet. Explore the financial benefits and operational efficiencies in our detailed guide.